Minimize and Defer Capital Gains Taxes

If you have owned public equities over the past year or longer, or if you are a corporate executive and you’ve received stock in your publicly traded employer, you probably have some appreciated equities that if sold would result in significant capital gains taxes. With federal capital gains tax rates of 23.8 percent (including the excise tax on Net Investment Income enacted to fund the Affordable Care Act), plus state taxes levied on top of that, selling some or all of your appreciated stock outright can significantly erode the value of your investment portfolio.

The Rundown

Timely thoughts and commentary on taxes and finances

Depending on your particular circumstances, you might employ one or more of the strategies below to defer and minimize capital gains taxes.

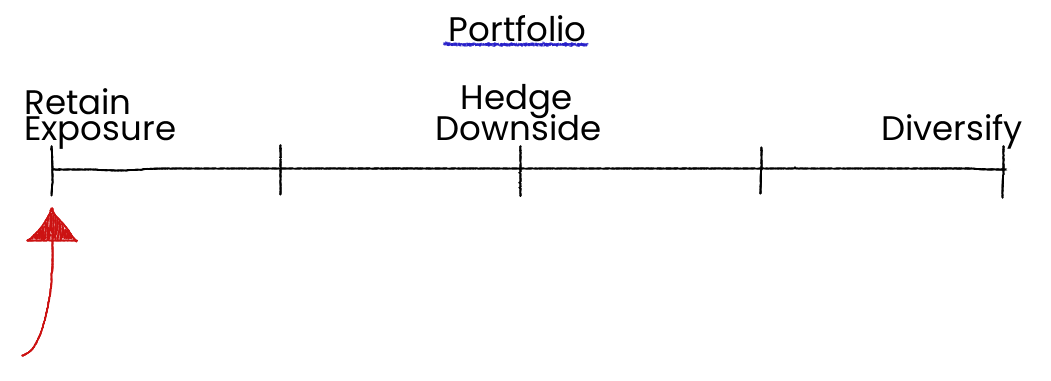

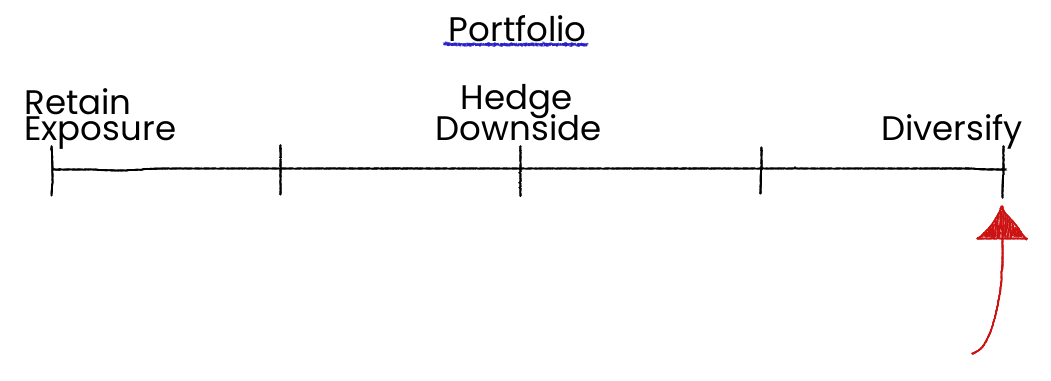

The strategies vary from those that generate liquidity to those that reduce liquidity and include several that result in a more diversified portfolio, hedge against declines in value, and retain full exposure to the stock.

While this article focuses on strategies for publicly traded stocks, some of the strategies can be used with other assets, such as art and collectibles.

The priority of desired outcomes will determine which of the techniques to reduce and defer capital gains taxes outlined below may be preferred, since they each offer varying degrees of tax mitigation, liquidity changes, exposure to further appreciation and depreciation, and ongoing control of the underlying security. They also have associated non-tax costs that need to be considered. For corporate executives and public company insiders, disclosure and reporting requirements should be considered. If you’re well-known, these techniques can land you on the front page of widely-read publications.

While you might want to employ some of these techniques, keep in mind that rising tax rates and changes in the way in which capital gains are taxed (like a mark-to-market tax regime) could eliminate the benefits currently afforded by these strategies. Qualifying for some of the tax benefits described in this writing requires meeting a number of conditions, and it is therefore essential to consult a tax and financial advisor prior to implementing any of these strategies.

The strategies are as follows (details for each follow below):

Securities-based line of credit – a loan securitized by one’s investment portfolio;

Variable Prepaid Forward Contract – a contract to sell one’s stock in the future for an amount to be determined within a predefined range;

Exchange Funds – a fund in which an investor contributes an appreciated stock in exchange for a portfolio of diversified stocks that are locked up for seven years and then distributed to the investor;

Stock Protection Funds, Put Options, and Zero Cost Collars – a way to hedge the volatility and risk of one’s stock. In the former, one pools their stock and cash with a portfolio of other investors’ stocks and cash; and in the latter two, one purchases options that either gain value when the value of the investor’s appreciated position falls or that eliminate further appreciation and depreciation in the underlying stock;

Qualified Opportunity Zone Funds – a real estate fund in which an investor contributes the portion of the proceeds equal to her or his gain on the sale of an appreciated asset;

Completeness Portfolio, Index-Tracking Portfolio and Tax Loss Harvesting – methods to construct a bespoke, diversified portfolio incorporating an appreciated stock and the investor’s other assets; and

Gifting & Philanthropy – leveraging the benefits afforded by the tax law for donating certain appreciated assets.

Securities-Based Line of Credit

If you want to continue to hold a position and are just looking to raise more cash, a securities-based line of credit from the bank in which your securities are held is a simple solution. This is probably what Elon Musk used to obtain at least $548 million in loans from banks that serve Tesla.

In today’s low interest rate environment, you might find rates in the 1% range and which float tied to a benchmark such as LIBOR. These facilities typically require interest to be paid monthly and the proceeds cannot be used to purchase more securities.

But, cash is fungible so there might be ways to use this loan in conjunction with cash from other sources to buy other securities if that’s your objective. If the value of your securities falls, you could be required to post more collateral or make a principal payment on the loan.

Variable Prepaid Forward Contract

This forward contract is a good solution for an investor, founder or corporate executive – like WWE CEO Vince McMahon – who wants to lock in the appreciation on a stock and raise some cash.

The owner of the stock enters into a contract with an unrelated party, typically a bank, agreeing to sell them her or his shares and leaves key pieces of the agreement to be determined at the end of the contract period so that the amount of gain is not yet fixed.

Upon entering into the contract, the seller receives cash from the buyer – typically between 75% and 90% of the current value of the stock – in exchange for a pledge to deliver a number of shares that will be determined upon closing of the contract based on an agreed upon formula.

The exact details will vary from one contract to another, but generally, the contract’s term (i.e., the deferral period) is around three years and during the contract period the seller will only participate in the stock’s appreciation and depreciation to a limited and defined extent and any further appreciation or depreciation is borne by the buyer. [i] The IRS has blessed this technique in a ruling that can be used as precedent. To avail oneself of this ruling the contract must satisfy certain requirements. [ii]

Exchange Funds

Exchange funds can work well for anyone with a large position in an appreciated stock who wants to diversify into a portfolio of other publicly traded stocks without realizing capital gains tax.

This strategy is commonly used by corporate executives with a concentrated position they wish to diversify. These funds are offered and managed by select brokerages who accept your stock into the fund in exchange for an interest in the fund.

The fund holds a basket of publicly traded stocks and 20% of its assets are usually comprised of real estate since tax laws require the fund to have 20% of its holdings in assets that are not stocks and securities. Each fund has a benchmark they aim to meet or outperform, such as the S&P 500 Index or Russell 1000.

Other conditions required to comply with the tax laws include a mandatory seven-year commitment, meaning you generally cannot sell or redeem your interest in the fund until seven years have lapsed.

At the end of the seven-year period you can redeem your interest in the fund for your pro rata share of the fund’s assets, which include the diversified portfolio of stocks held by the fund that correspond to the benchmark’s index.

The net result is an exchange of your single concentrated position for a diversified portfolio. Should you ever then sell any of the stocks you received from the fund, the associated gain or loss is determined by referencing the basis in the stock you had originally contributed to the fund. At this point you would then look to employ other strategies like those described in this writing to mitigate any tax on the sale of a stock received upon redemption.

The fund interest qualifies for the basis step up at death, as would the stocks received upon redeeming one’s interest in the fund. Since the fund managers have a benchmark they seek to replicate, some funds may not accept certain stocks. While invested in the fund the investor is likely to bear some taxable income from their share of the fund’s dividends and/or capital gains in the event that some of the fund’s securities are sold or liquidated.

Stock Protection Funds, Put Options, and Zero Cost Collars

Stock protection funds, put options, and zero cost collars are used by those who have an appreciated position and who wish to protect (i.e., hedge) their downside.

While zero cost collars eliminate further appreciation and depreciation, both stock protection funds and put options hedge the investor’s downside while preserving their participation in the stock’s further appreciation.

Though these latter two techniques have similar objectives, stock protection funds typically offer better economics and more favorable tax treatment than put options. With these three strategies, the investor continues to own the stock and needs to have sufficient liquidity to put up some cash at the term’s inception. The option and collar strategies can have any duration desired, and most protection funds have a five-year commitment.

To form a protection fund, twenty or more diversified stocks are “pooled” and the participants contribute cash into a fund that is typically invested in Treasury bills during the term of the fund. At the end of the term, protection funds use the cash pool to reimburse the participants whose stocks have declined in value on a total return basis until the pool is depleted. If the pool exceeds all losses, the excess cash is rebated to investors. If the total losses exceed the cash pool, those losses are offset by the cash pool. During the fund’s term, investors gain the downside protection offered by portfolio diversification without having to fund and construct a diversified portfolio for their own account. The investors’ shares remain unencumbered, meaning they can be sold, borrowed against, pledged, etc. At the end of the protection fund’s term, the investors will have a long-term capital gain or loss to the extent that the cash received exceeds or is less than the cash originally contributed.

Current tax laws permit this structure as long as certain specified conditions are satisfied. The laws contain what are referred to as “constructive sales” and “straddle” rules. If not executed correctly these rules could apply to the put option and stock protection fund strategies, in which case one could unknowingly trigger the capital gains tax and/or have dividends that would otherwise have qualified for the lower capital gains tax rate re-characterized as ordinary income.

Qualified Opportunity Zone Funds

Qualified Opportunity Zone Funds, which were borne out of the Tax Cuts and Jobs

Act of 2017, might be appropriate for those who wish to reduce or eliminate their position in an appreciated stock (or any other appreciated asset) and who are open to shifting that portion of their assets into real estate.

The gain from the sale of the stock may be reinvested in a fund and the associated gain will be deferred and potentially reduced provided certain conditions are met.

Since only the gain is required to be reinvested in the fund this strategy can generate some liquidity for the seller — to the extent of their basis in the stock sold. Many investment institutions and real estate investment firms offer these funds to qualified investors though there is no requirement to invest through an institution, and therefore investors with sufficient liquidity can organize their own funds.

That said, there are myriad rules and requirements that the fund itself must meet to qualify for the tax benefits so it’s best to have professional tax and real estate advisors involved should one decide to form or invest in a fund.

To qualify for the tax benefits, the investor is required to make the investment into the fund within 180 days of selling the appreciated stock. The gain that has been deferred must be recognized by the earlier of the date the fund interest is sold or by December 31, 2026. Thus, investors in these funds must plan ahead to ensure sufficient cash is available to pay the associated tax liability for the 2026 tax year should their interest in the fund continue beyond 2026. If the investor holds the position in the fund for at least five years, only 90 percent of the deferred gain is recognized; and only 85 percent of the gain is recognized if the investment is held at least seven years. However, because both the five and seven-year periods must occur on or before December 31, 2026, to qualify for these reductions the investment in the fund would have had to occur by Dec. 31, 2019 to qualify for the 15 percent reduction and by Dec. 31, 2021 to qualify for the 10 percent reduction. An investor who holds the interest in the fund for at least ten years can sell their interest in the fund without recognizing the gain on appreciation attributable to the amount that was invested in the fund.

Completeness Portfolio, Index-Tracking Portfolio and Tax Loss Harvesting

A completeness portfolio is a strategy that could be used by someone who desires a diversified portfolio but who has a concentrated, appreciated position and significant liquidity.

In this strategy, an investment manager will devise a portfolio that meets the investor’s investment objectives and constructs that portfolio while incorporating the investor’s concentrated position into the portfolio.

In this case the investor does not need to sell the concentrated position, but instead invests the position plus cash, which could be obtained on margin, to build out the bespoke, desired portfolio.

If, for example, the investor wants to replicate the S&P 500 Index and has a concentrated position in Microsoft, which as of the time of this writing comprises roughly 5% of the index, she or he would contribute the Microsoft stock plus cash equal to 19 times the value of the contributed stock so that the investment manager could purchase the other components of the index at the weighting required to replicate the index.

Building on the completeness portfolio, many investment managers are now constructing index-tracking portfolios for their clients in lieu of investing in the index through an ETF or other single stock that represents the index. Within the index, over time there will likely be stocks that have appreciated and those that have depreciated. The investment manager will opportunistically sell the stocks that have declined in value to harvest the losses which can then be used to offset gains realized by opportunistically selling down the concentrated position(s), reducing the single-stock risk. This is done gradually over a long-term time horizon.

Gifting & Philanthropy

For those who regularly contribute to charities and/or who make gifts in accordance with an estate plan, a simple and often overlooked strategy is to give away the appreciated position(s).

In this case, because of the step-up in basis at death afforded under current tax laws, gifting highly appreciated assets can be less favorable than gifting assets that haven’t yet appreciated. However, in the case of charitable gifting, the tax laws offer a significant benefit for certain appreciated assets.

For appreciated stock that satisfies the long-term capital gains holding period (generally one year), it may be beneficial to donate appreciated stock directly to the charity rather than selling the stock, which would trigger the capital gains tax, and then donating the proceeds. In this case, investors are better off donating the shares with the lowest cost basis.

Gifts to qualified charities are generally deductible as an itemized deduction. Under current law, depending on the year of donation, the type of charity to which the donation is made, and the property that is donated, the contributions will be limited to varying percentages of the donor’s adjusted gross income. Donations that are capped due to these limitations carry over to subsequent years, limited to five years. Generally, the limit afforded to donors for cash donations is greater than the limit for donations of other assets, including appreciated stock. Because the limits are a moving target under current law, if you proceed with this strategy you should consult with a tax advisor to ensure you obtain the maximum benefit.

Other Strategies

This is certainly not an exhaustive list of strategies one can use to defer or mitigate capital gains taxes on appreciated stock. There are other strategies employed by those who have concentrated, appreciated positions. And since every situation is unique, there may be opportunities available to you due to your particular set of facts and circumstances that might be more beneficial than those listed in this article. There are also strategies one might come across that may be more aggressive in nature and that if not carefully vetted by a trusted professional could result in significant penalties and current tax liability. Like the rest of the tax code, within these techniques are many traps for the unwary, so proceed only after obtaining guidance from professional tax and investment advisors.

[ii] This is accomplished by a formula that varies the number of shares or cash that is to be delivered from the seller to the buyer upon completion of the contract depending on the price of the stock at the contract’s termination.

[iii] Those requirements include but are not limited to the following: the seller retains the right to substitute cash for the shares and isn't compelled to deliver the shares, and that during the term of the contract the buyer retains the right to vote the shares, but not to lend or sell them.

No warranty or representation, express or implied, is made by Toplitzky&Co, nor does Toplitzky&Co accept any liability with respect to the information and data set forth herein. Distribution hereof does not constitute legal, tax, accounting, investment or other professional advice.

Securities based line of credit